At the Board of Directors meeting held on July 2, 2025, the Company approved the appointment of Ms. Jean Liu, General Manager, as the Group’s Corporate Governance Officer. Ms. Liu has previously served as the Company’s Corporate Governance Officer for over four years.

The main duties of the Corporate Governance Executive include at least:

The business implementation of year 2025 was as follows:

| Course Date | Organizer | Course name | Hours |

|---|---|---|---|

| 2025/09/16 | Taiwan Corporate Governance Association | Corporate Governance Officer and Board Members | 3 |

| 2025/10/16 | Financial Supervisory Commission | The 15th Taipei Corporate Governance Forum | 6 |

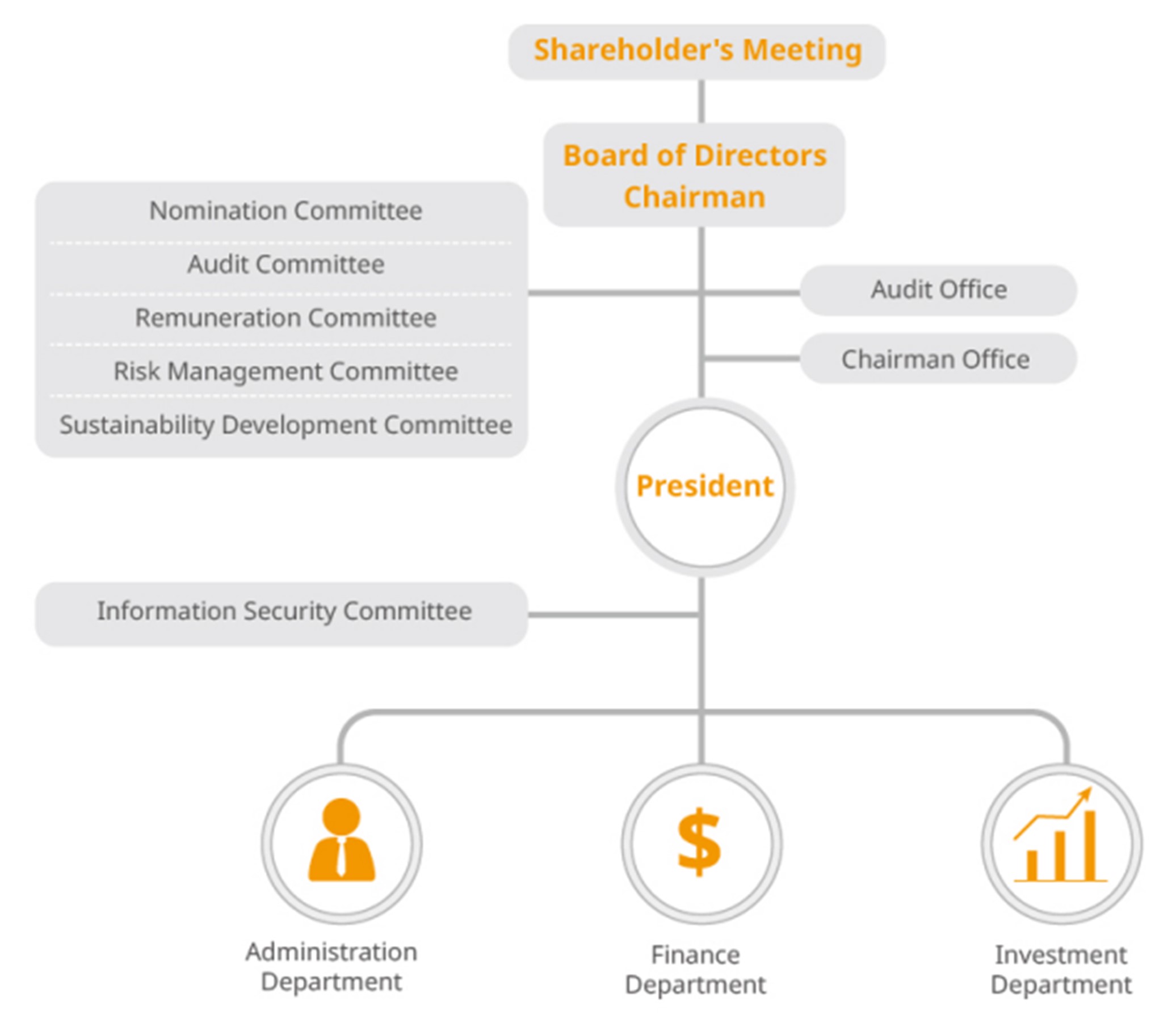

Dynamic Holding (3715) was newly listed on August 25, 2022. The board of directors was fully re-elected on May 18, 2023. On May 29, 2023, the Risk Management Committee was established under the board of directors, and on December 16, 2024, the Sustainability Development Committee was formed under the board of directors.

Responsibilities of the Board of Directors

The company's board of directors should guide the company's strategy, supervise the management, and be responsible to the company and shareholders. The operations and arrangements of its corporate governance system should ensure that the board of directors exercises its powers in accordance with laws, regulations of the company's articles of association, or resolutions of the shareholders' meeting.

Board of Directors Evolution

On May 20, 2022, Dynamic Electronics held a general meeting of shareholders, and passed its establishment of the new company "Dynamic Holdings Co., Ltd." through the manner of share swap and became a 100% subsidiary of Dynamic Holding. Pursuant to Article 29 of the Business Mergers and Acquisitions Act, the shareholder meeting was deemed to be a newly established promoters' meeting of Dynamic Holding, so that shareholders of Dynamic Electronics could discuss and decide the Articles of Association of Dynamic Holding as promoters, and at the same time the directors and supervisors of Dynamic Holding were elected.

On August 25, 2022, Dynamic Holding obtained the approval of the Ministry of Economic Affairs for company establishment registration.

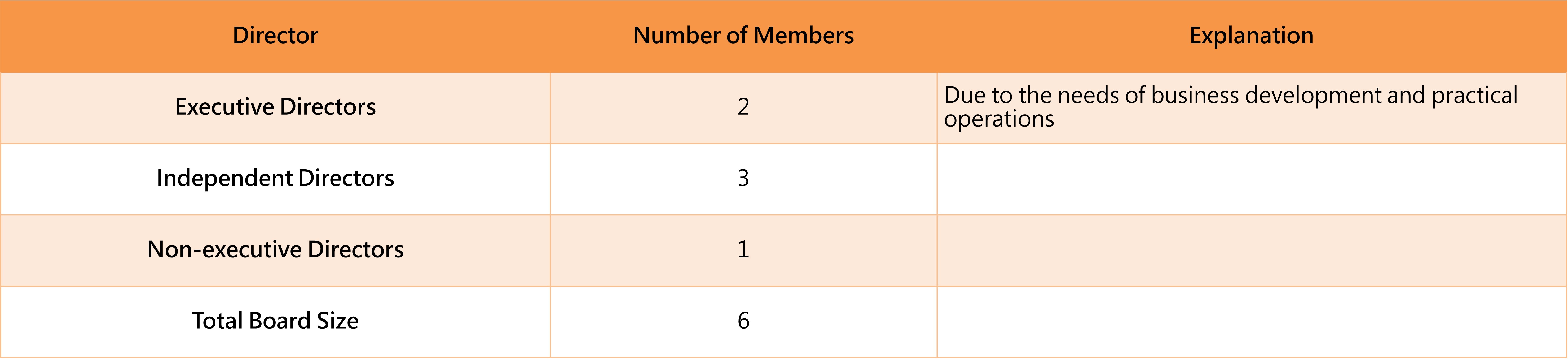

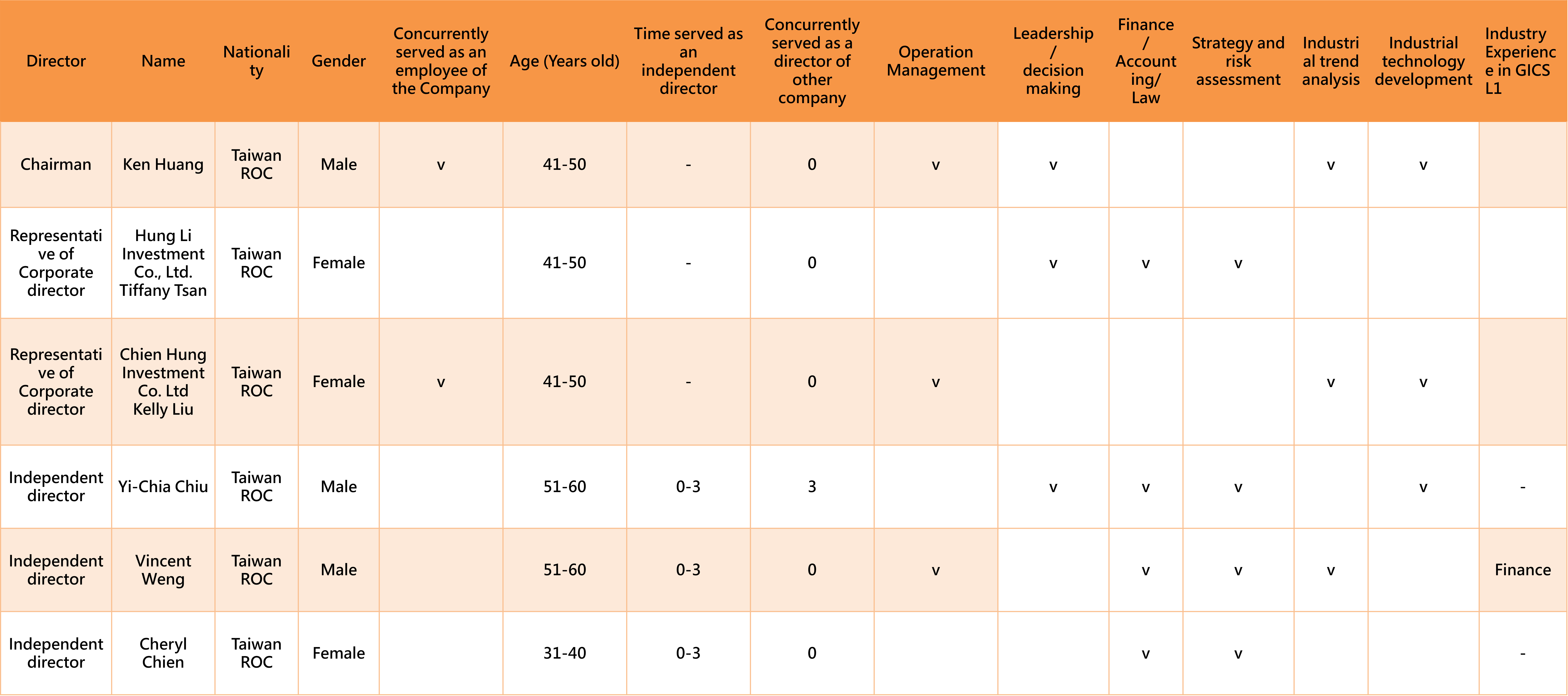

On May 18, 2023, Dynamic Holding conducted a full re-election of its board of directors, electing three directors and four independent directors. The expertise of the directors spans various areas, including strategy, operations, risk, finance, technology, finance, law, and corporate governance, with one female independent director among them. On November 4, 2024, two corporate directors replaced their representatives with female, bringing the number of female directors to three, representing more than one-third of the board seats. Dynamic aims to lead the group toward sustainable corporate development with a more professional, independent, and diversified board structure.

Board of Directors Objectives and Achievements

2024 Board Objective: Increase the number of female directors and strengthen the presence of directors with expertise in ESG and advanced technologies.

Achievement: The number of female directors increased from one to three, making up more than one-third of the board seats. Additionally, the newly appointed directors have a strong passion and mission for corporate sustainability.

2025 Board Objective: Elect an independent director with expertise in smart manufacturing and information/network security.

Achievement: On May 22, 2025, Mr. Vincent Lin was elected as an independent director, possessing expertise in smart manufacturing and information/network security.

2026 Board Objective:

1. Reduce the proportion of corporate directors to enhance the board’s independence and accountability, mitigate potential conflicts of interest, and optimize the corporate governance structure.

2. Conduct a full board re-election to continuously strengthen the diversity and balance of board members, covering different professional backgrounds (e.g., legal, accounting, and industry expertise), gender, age, professional skills, and industry experience, thereby building a complementary board composition to improve governance quality and decision-making effectiveness.

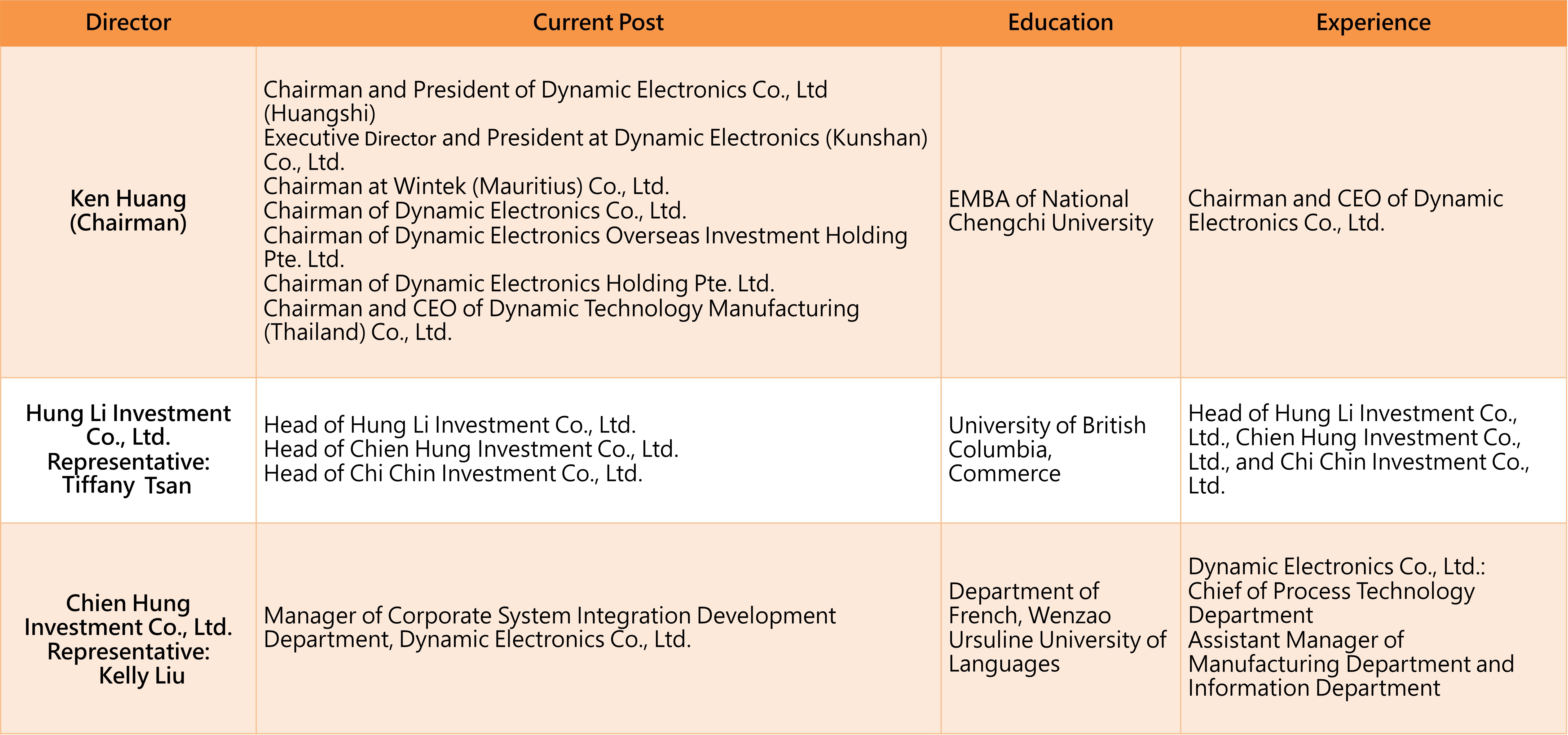

Board of Directors

Independent Directors

Profile of the Directors

Profile of Independent Directors

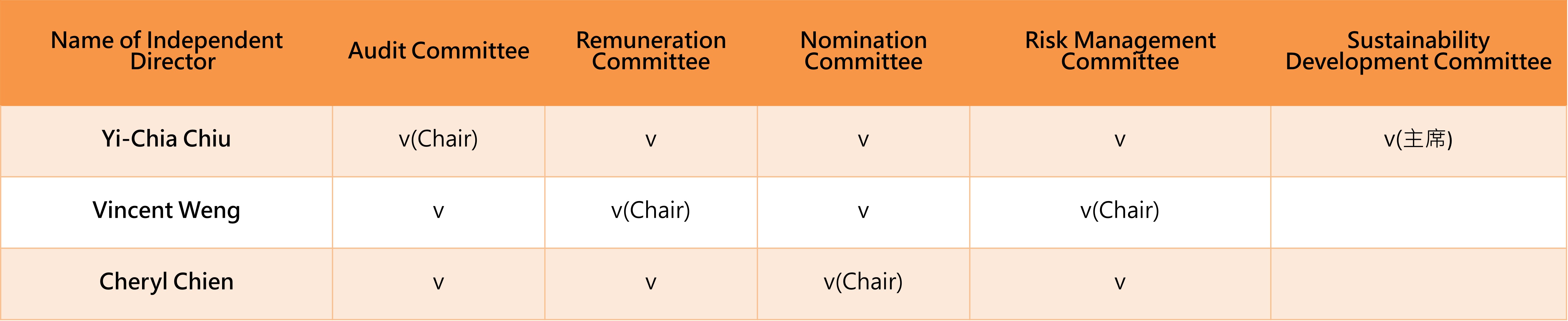

Responsibilities of each Independent Director on Functional Committees

The Company's Code of Corporate Governance Practices article 20 indicates that the composition of the board of directors shall be diversified. one should also formulate an appropriate diversification policy for his/her own function, operational style and development needs, including but not limited to the following two standards:

1. Basic conditions and values: gender, age, nationality and culture.

2. Professional knowledge and skills: professional background (such as law, accounting, industry, finance, marketing or technology), professional skills and industry experience.

The board members should generally possess the necessary knowledge, skills and literacy to perform their duties. In order to achieve the ideal goal of corporate governance, the overall ability of the board of directors should be as follows:

1. Good judgement in operations.

2. Accounting and financial analysis capabilities.

3. Business management capabilities.

4. Crisis handling abilities.

5. Industrial knowledge.

6. Vision to international market.

7. Leadership.

8. Decision-making ability.

Dynamic Board Diversity Policy:

1. Basic conditions and values, such as diversity in gender, age, race, ethnicity, nationality or culture.

2. Diversification of professional knowledge, professional skills and industrial experience.

Specific Management Goals and Achievements of Dynamic Diversification Policy

1. Board Re-election in 2023:

Dynamic Holding was established on August 25, 2022. On May 18, 2023, a full board re-election was conducted, resulting in the selection of three directors and four independent directors. The directors' expertise spans areas such as strategy, operations, risk management, finance, technology, banking, law, and corporate governance. The board also included one female independent director.

2. 2024 Targets and Achievements:

The number of female directors increased from one to three, accounting for more than one-third of the Board seats. Newly appointed directors demonstrate strong commitment and a sense of mission toward corporate sustainability. Further enhancement is needed in the appointment of independent directors with expertise in AI and advanced technologies.

3. 2025 Targets and Achievements:

An independent director with expertise in smart manufacturing and information / cybersecurity was appointed through a by-election, which was completed on May 22, 2025.

4. 2026 Targets:

1. Reduce the proportion of corporate representative directors to enhance Board independence and individual director accountability, mitigate conflict-of-interest risks, and optimize the Company’s corporate governance framework.

2. Conduct a full Board re-election to further strengthen the diversity and balance of Board composition, encompassing a broad range of professional backgrounds (such as legal, accounting, and industry expertise), gender, age, professional skills, and industry experience, thereby building a complementary Board structure to enhance governance quality and decision-making effectiveness.

Second Term of the Board of Directors

Term Duration: May 18, 2023, to May 17, 2026.

From January 1, 2025, to December 31, 2025, a total of fourteen board meetings were held.

The attendance of directors is detailed as follows:

Note:

Note:

1. The minimum attendance percentage required by the company is 80%.

2. Independent Director Vincent Lin was elected and took office on May 22, 2025.

Performance appraisal indicators for directors and executive managers

CEO Compensation – Long-Term Performance Alignment

The bonuses for the company's senior executives (including the CEO/President) are paid in four quarters in the following year. If a certain percentage of bonuses is paid out in shares, it will be paid out in trust form over three years.

Executive Shareholding Requirements

Starting in 2023, Dynamic established regulations on shareholding requirements for managers. The required shareholding value is set as a multiple of the annual base salary: six times for the General Manager and one time for other managers combined. Managers are required to meet the shareholding target within five years of their appointment.

Calculation Formula:

(Year-end stock price × Manager's shareholding) ÷ Manager's base salary

Achievement in 2024:

Both the General Manager and all other managers successfully met the shareholding targets.

General Manager-to-Employee Pay Ratio

In 2024, the General Manager's total compensation was approximately NT$3,840,000.

● TThe ratio of the General Manager's compensation to the median annual salary of all employees (excluding the General Manager), which was NT$714,429, was approximately 5.38:1.

● The ratio to the average annual salary of all employees, which was NT$1,022,826, was approximately 3.75:1.

In view of the limited managerial career time of each senior manager, the company must carry out the successor program a considerable time before the end of the managerial career of those in key positions in order to prepare the succeeding talents; so that the company can realize sustainable development. In year 2016, the company established successor program for key positions, and has been tracking and developing high-potential talents to systematically and effectively acquire human resources of the organization.

In the company's succession planning, in addition to being professional and having outstanding executive ability, the successors must reach a consensus with the company on values. The successors should be possessed of honesty, enthusiasm, customers’ trust, innovation.

Dynamic's business philosophy is customer satisfaction, commitment to quality, continuous innovation, smart manufacturing and corporate sustainability, This is the philosophy that all of our senior executives at Dynamic must uphold in management.

For each successor candidate, the incumbent of the relevant position formulates a training plan. The development progress and implementation status are updated annually and submitted to the Board of Directors for review. To avoid affecting the successor candidates’ work mindset and to allow for objective observation of their performance, adjustments or replacements may be made when necessary. Accordingly, we do not disclose the identities of the successor candidates to the individuals concerned or to others. In 2025, Dynamic Holding reviewed a total of eight positions under this program (including the Chairman, Independent Director, President, Senior Vice President, Chief Financial Officer, Head of Human Resources, Head of Environment/Occupational Safety, and Head of Internal Audit) and further developed corresponding training programs. The training content is individually designed by the incumbents based on the requirements of each position and the needs of each candidate, including but not limited to individual development plans, a mentoring and coaching system, online development courses, and senior management strategy alignment workshops, with the aim of cultivating successor candidates needed over the next 3–5 years and 5–10 years.

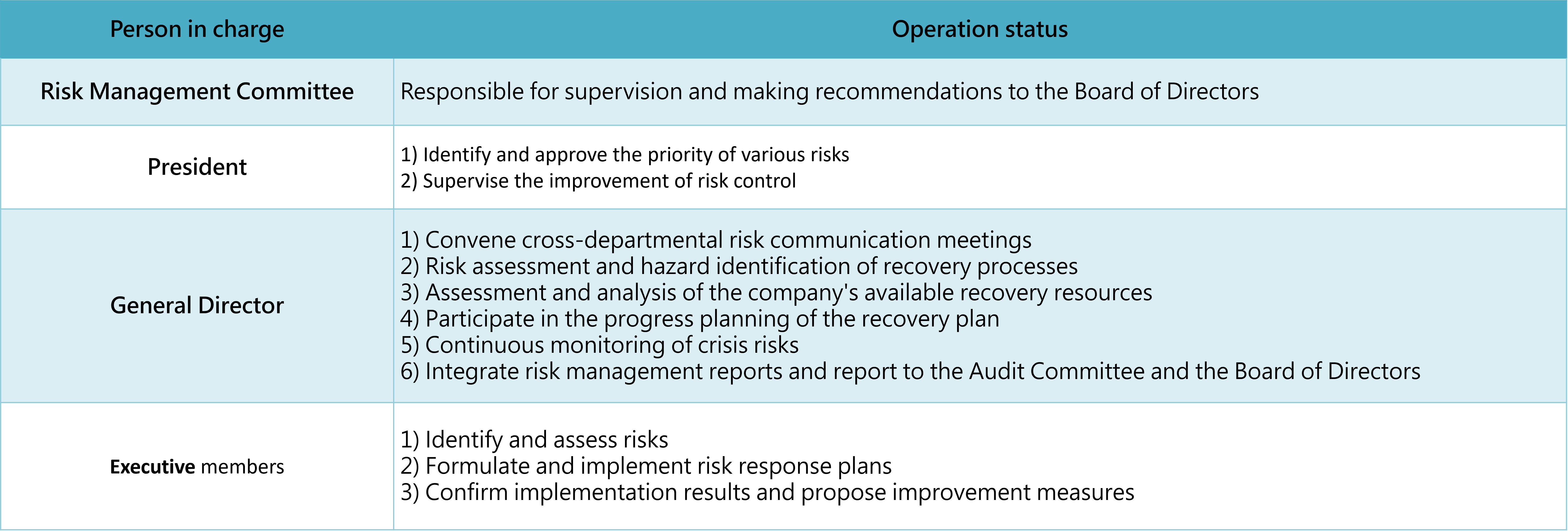

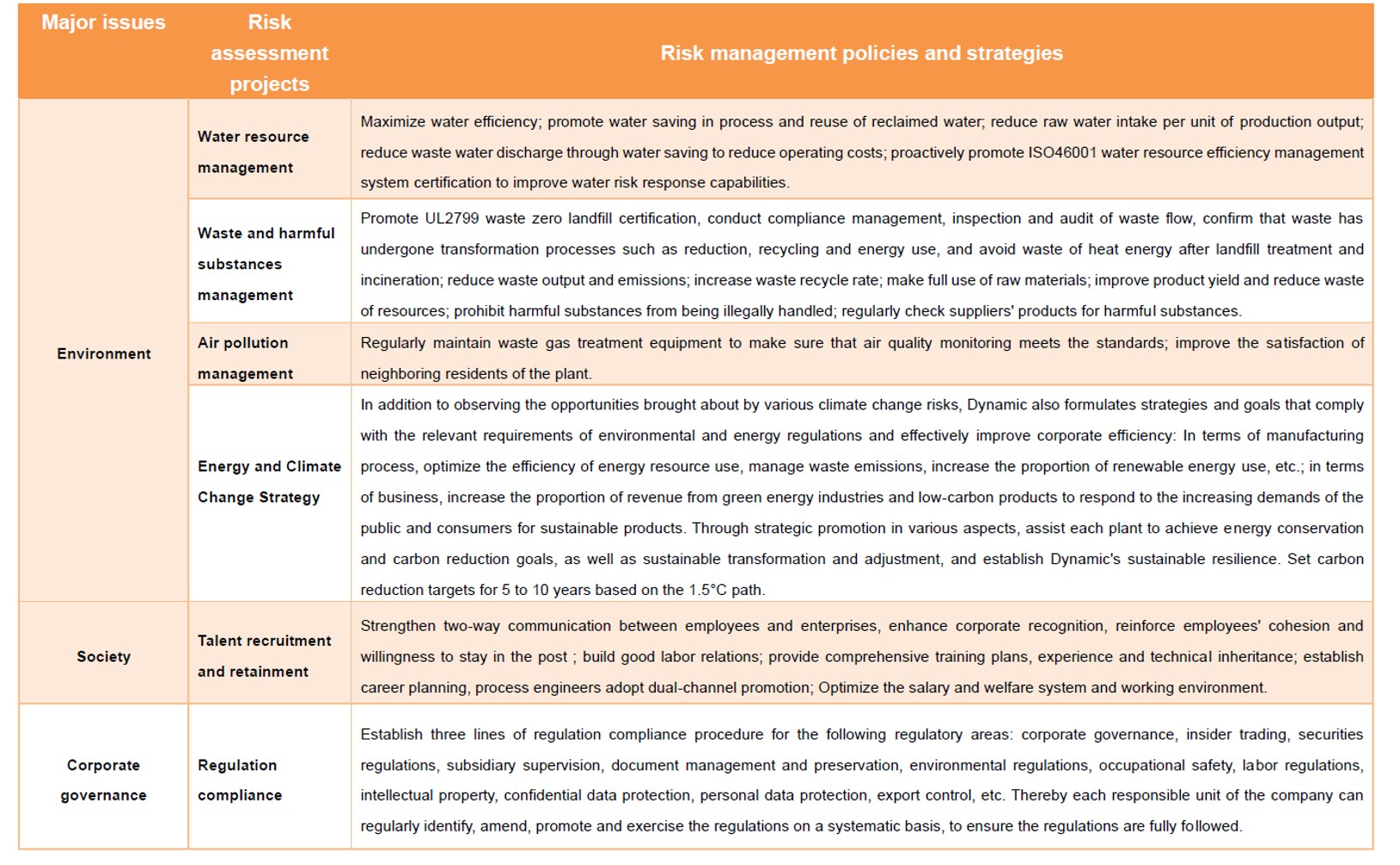

Risk Management Policies and Procedures

The company formulated the "Risk Management Policy" on October 30, 2015, and established the "Risk Management Committee", which was approved by the board of directors as the highest guiding principle and execution unit of the company's risk management. The risk management committee of the company regularly evaluates the frequency of internal and external risks and the severity of the impact on operations through the risk matrix (Risk Map) on a quarterly basis, and defines risk levels and priorities, hoping to respond in a cost-effective manner. At the same time, according to the latest internal audit development and standard requirements, monitor the potential risks of internal operations and implement preventive measures to strengthen risk management, and report quarterly to the board of directors. In addition, we evaluate and disclose the major issues in the ESG report every year based on the opinions of internal and external stakeholders of the company, and include them in our risk management process for evaluation and discussion.

On May 29, 2023, to strengthen the functions of the Board of Directors and enhance the risk management mechanism, the Board appointed four independent directors to serve as members of the first Risk Management Committee. The committee was established under the Board of Directors and operates in accordance with the "Risk Management Committee Organization Regulations," which were approved by the Board on August 4, 2023. The term of the first Risk Management Committee members is effective from May 29, 2023, to May 17, 2026, aligning with the term of the current Board of Directors.

Risk Management Category

The Risk Management Committee assesses and discloses significant issues related to strategic risks, operational risks, financial risks, hazard and climate change risks, business ethics and human rights risks, as well as other hidden risk factors based on the perspectives of both internal and external stakeholders. These risks are evaluated and disclosed in the ESG report. The committee also monitors and supervises the execution of control measures, ensuring the effective use of resources to uncover potential opportunities and mitigate the greatest crises.

Operation of the Risk Management Committee

The Risk Management Committee under the Board of Directors is responsible for monitoring and making recommendations to the Board of Directors. The executives in the management team who are responsible for strategy, operations, finance, hazards, climate change, business ethics, human rights, Stakeholders' engagement etc., continuously evaluate the impact of external economic, environmental, and social changes on the organization, thereby looking for opportunities, and formulating countermeasures and action plans. The report is summarized and submitted to the General Manager for approval, and then supervised by the Risk Management Committee. Its operation is as follows:

The Risk Management Committee’s report date and risk topics to the Board of Directors in 2025 are as follows:

| Date of the report of Risk Management Committee to the Board of Directors |

Risk Issues |

|---|---|

| 2025/02/26 | Matters for Reporting: Risk Management of U.S. Additional Tariffs on Mexico, Canada, and China |

| 2025/04/28 | Matters for Reporting: 1. Impact Assessment of Trump’s Reciprocal Tariffs 2. Tracking of Geopolitical Risks |

| 2025/12/15 | Matters for Reporting: 1. Summary of Corporate Risk Assessment Survey Results 2. Business Risk Assessment and Action Plans 3. Talent Shortage Risk Assessment and Action Plans for the Thailand Plant 4. Technology Change Risk Assessment and Action Plans |

I. Internal audit organization:

II. Internal audit operation:

In 2025, the company implemented internal regulations prohibiting directors, employees and other insiders from using undisclosed information in the market to buy and sell securities. The implementation is as follows:

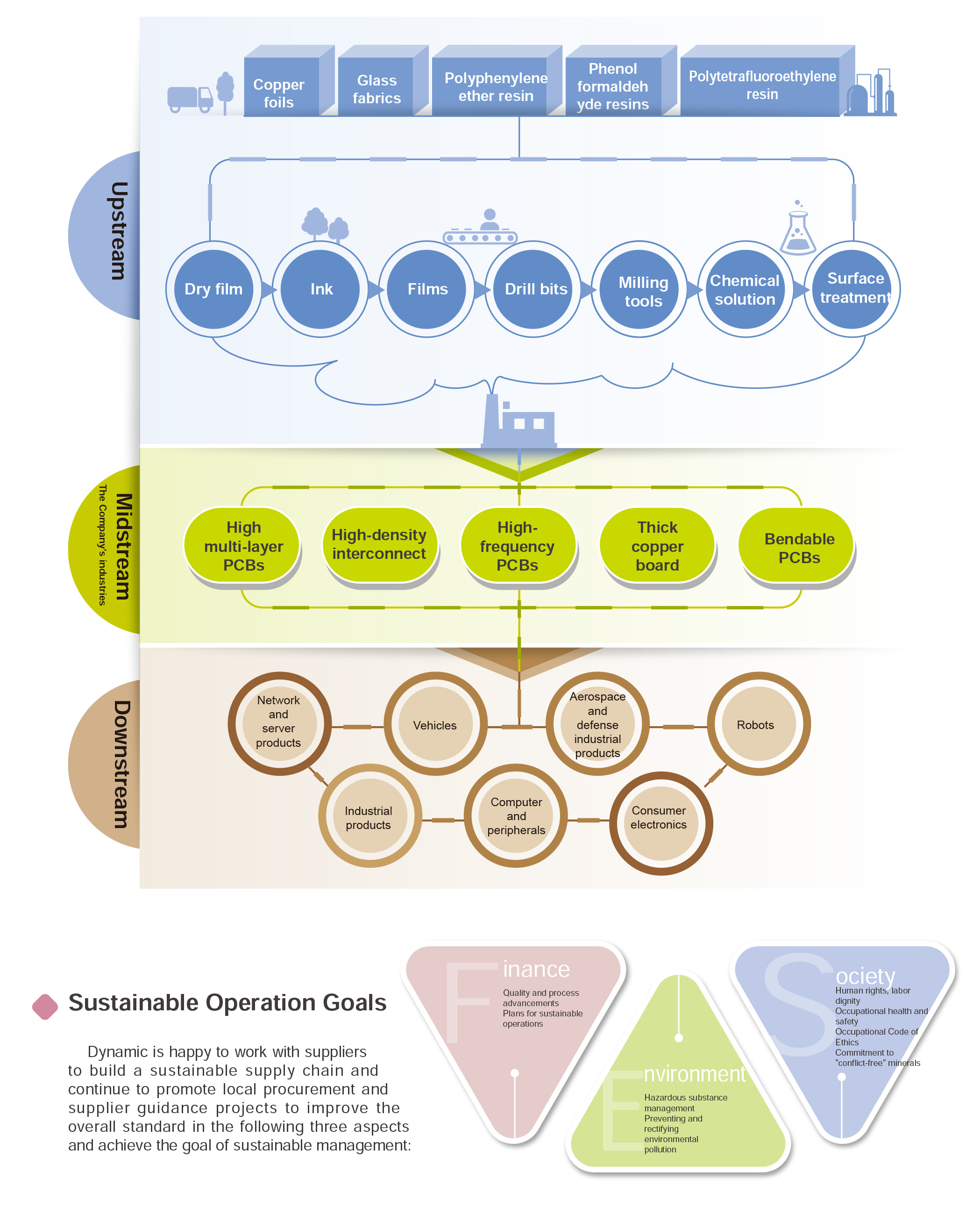

Supply Chain Structure

1. Copyrights and Trademarks All text, audio/video, information, patterns, pictures, sounds, and animation that are disclosed on this website have been provided by Dynamic Holding Co., Ltd. (hereafter referred to as Dynamic Holding) or other originators and are legally protected by domestic and international copyright laws. If you have not been given written authorization by Dynamic Holding, you are not allowed to reproduce, broadcast, publicly display, transmit, or distribute information provided by this website or use the information for other commercial uses. However, if your scope of use is limited to personal non-profit use, Dynamic Holding will authorize you to browse, print, download, or store information provided by this website.

Written approval shall be obtained from Dynamic Holding prior to the use of any trademarks or patterns owned by Dynamic Holding, Dynamic Holding Co., Ltd.

2. Disclaimer Dynamic Holding’s objective in providing this website service and data is for the convenience of website users. Dynamic Holding has not conferred any authorization or ownership to any such services or data. Dynamic Holding cannot guarantee the accuracy, comprehensiveness, and reliability of items and data in this service, or on this server or other servers. Thus, users should not rely on the services and data provided by this website unless Dynamic Holding recommends users to do so with written notification. Please do not rely on this service or data provided to purchase, sell, or transaction in securities. Please note, the information provided here does not satisfy the requirements of different national governing bodies, including, but not limited to, the information disclosure requirement of the Taiwan Stock Exchange and the Securities and Exchange Act. Please do not make any investment decision based on the services and data provided by this website.

3. Limited warranty All information and data, including text, patterns, or other projects carried on this website and other websites linked to this website can be revised or updated without additional notice, and are provided based on current status. Dynamic Holding does not guarantee the accuracy, reliability, or comprehensiveness of the information and data, and does not provide any implied, express, or statutory representations and guarantees. This includes, but is not limited to, non-infringement, ownership, merchantability, quality, appropriateness for specific usage, and absence of computer viruses.

4. International users This website is controlled, operated, and managed by the Dynamic Holding Taiwan headquarters. Dynamic Holding does not guarantee that the data on the website is suitable for any other locations outside the Republic of China, or that you can view these data from areas where the data is perceived as illegal. Users shall not use the website or export data against ROC export regulations. If users visit the website from locations outside of ROC territories, then users are obligated to follow all local regulations. These provisions and conditions on use are under the jurisdiction of the ROC regulations, and are not counter to ROC legal provisions.

5. Revisions Dynamic Holding can revise these provisions at any time. Users should visit this website often to understand current provisions. Parts of provisions may also be announced or replaced by clear and specific regulations on this website.

Dynamic Holding can terminate, revise, or stop any aspect of this website at any time, including any specific item availability of this website. Dynamic Holding can conduct these changes without prior notice, and is not responsible for providing specific characteristics or services on the website, or for limiting users from visiting parts of the website or the entire website.

Dynamic Holding can terminate the aforementioned authorization, rights, and permissions at any time. Users shall erase all data upon the termination of these authorizations, rights, and permissions.

6. Governing laws, dispute processing, and interpretation

Republic of China laws are applicable for disputes that result from this announcement or the use of this website.

Negotiations shall be used to settle disputes that result from this announcement or the use of this website. If negotiation fails, then litigation in the Taoyuan District Court (Taiwan) shall be used to solve the dispute.

The interpretation rights of this announcement and interpretations rights used in this website belong to Dynamic Holding

7. Contact us If you have any opinions, questions, views, or concerns about this policy, or if you believe any incompliance of this policy is occurring, please feel welcome to contact us at any time.

Dynamic Holding Co., Ltd

Legal Office

6F., No. 50, Minquan Rd., Luzhu Dist., Taoyuan City 33846, Taiwan

Email: inquiry@dynamicpcb.com

Updated on Aug 25, 2022